Monday, 18 June 2012

Tweeting Against Fossil Fuel Subsidies is Fine, but...

There is a 24-hour "Twitterstorm" currently running to mark the Rio+20 environmental conference in Brazil. The #EndFossilFuelSubsidies tweet-a-thon is being organised by environmental group 350.org, to help push the issue onto the agenda of world leaders attending the conference.

The logic behind the campaign is obvious: fossil fuel combustion is the single largest source of man-made greenhouse gas emissions. We burn excessive fossil fuels in part because we fail to factor their environmental impact into the price. Carbon taxes and cap-and-trade schemes are intended to help send more accurate (higher) price signals and thereby reduce demand. However, not only are we failing to implement aggressive carbon pricing schemes, nations around the world actually offer billions of dollars of subsidies that lower the price of fossil fuel production and consumption. Other subsidies are non-financial: relaxing environmental restrictions in protected areas reduces compliance costs for fossil fuel producers, making it easier to increase supply at a given price.

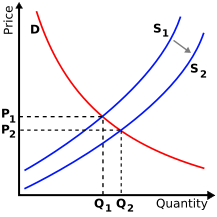

What would compel otherwise rational decision makers to support such an illogical policy? In a nutshell, it's a lack of joined up thinking. Why subsidise fossil fuel production? To shift the supply curve out to the right - increasing supply, reducing price, or both, as seen below:

Why do we need to increase supply? Because we are consuming increasing quantities of fossil fuels. Why are we consuming so much? Because we are not using renewables. Because our buildings are inefficient, and we travel long distances in inefficient vehicles, and we manufacture large quantities of products in inefficient factories.

Why subsidise fossil fuel consumption? Because otherwise influential voters would revolt, poorer members of society would face fuel poverty, and manufacturers would threaten to take jobs elsewhere. Why are voters, households and employers sensitive to the price of fuel? Because their homes, vehicles and buildings use energy inefficiently and because they do not generate much, if any, of their own local power.

In other words, when confronted with the challenge of people using energy wastefully and failing to use locally available renewables, national leaders have responded with subsidies that boost production and lower the price of fossil fuels! You can see how policy makers might find this response rational on a case-by-case basis, but from a broader systems perspective the case for these subsidies becomes ludicrous. This "solution" becomes even more appalling when one considers the environmental cost.

A "big-picture" systems view can tackle these challenges simultaneously from an economy-wide and a local level. If it is too expensive to drive vehicles long distances when people must face the full cost of fuel, then we can find ways to reduce vehicle miles per person or per tonne of goods: putting homes or factories closer to offices, increasing fuel efficiency, and using mass transit to reduce the number of cars people need to own. If fuel costs are making homes unaffordable and businesses uncompetitive, then we can find ways to get the same benefits with less fuel: switch to renewables, where the "fuel" (sunlight, wind, etc) is free; or improve building and appliance efficiency so less energy is wasted.

#EndFossilFuelSubsidies is a clever campaign, but we need more systems-level thinking if it is to become more than a slogan that disappears after 24 hours.

Sunday, 3 June 2012

Small but Mighty: The 2012 State of the Voluntary Carbon Market Report

The State of the Voluntary Carbon Markets 2012 report was launched yesterday at Carbon Expo in Cologne, Germany. The Ecosystem Marketplace team has done a tremendous job, reaching across the industry to collect masses of data on carbon project transactions by project type, standard, geography, and a host of other criteria, and then slicing and dicing this data to tell a coherent story about supply, demand, and buyer behavior.

Analysts, investors, and project developers rely on the State of report to help them make informed decisions and grow the market. This is an extremely valuable service, and somewhat surprisingly, Ecosystem Marketplace provides all this information free of charge via their website. It's a public service, and a valuable one. Carbon Clear is a proud sponsor of the report. Just one more way we contribute to the low-carbon economy.

A key finding from this year's report is that the voluntary carbon market has continued to grow strongly, even in the midst of an international economic and financial crisis. In fact, 2011 was the best year ever in terms of over-the-counter transactions. Excluding one very unusual 2010 transaction on the now-defunct CCX system, carbon credit sales volumes rose 28% in 2011, and the average price per tonne rose, too.

In many ways, the launch of the 2012 report marked the coming of age of the voluntary carbon market. The organisers of Carbon Expo operate mainly in the compliance market, focusing on carbon credits from the Clean Development Mechanism and EU Emission Trading Scheme (EU ETS). With thousands of industrial emitters covered under the EU Emission Trading Scheme (ETS) and scores of brokers and investment banks transferring credits back and forth, the compliance market is well over a hundred times larger than the voluntary one. To an outsider, a Carbon Expo session focused on the voluntary market would seem a side show, unlikely to be of interest to the majority of delegates. In the event, Ecosystem Marketplace was allocated a small room away from the main hall in which to launch their report on the voluntary market. They didn't even have a microphone.

And then something quite unexpected happened. The main hall of Carbon Expo sat half-empty, while delegates flocked to Meeting Room 2 to listen to Molly Peters-Stanley and the rest of the panel. They filled every seat, sat on the floor, stood against the walls and spilled out into the corridor beyond to hear the latest news on the voluntary market. There were nearly as many people standing outside as managed to make their way in. In the photo below you can just make out the throngs in the hallway craning their necks to see into the room.

Why such a big crowd to hear about a relatively small market?

The voluntary market has an importance and influence that belies its size. First, it has been a source of experimentation and innovation that has shown time and again how carbon finance can deliver clear livelihoods benefits to families and communities in developing countries. Voluntary carbon projects are often more effective at channeling resources into pro-poor initiatives like improved cook stoves and safe drinking water. Many methodological innovations, like sampling-based monitoring and "suppressed demand" started in the voluntary carbon credit standards and have subsequently found their way into the much larger UN-backed Clean Development Mechanism. So the voluntary market can help compliance market players get a taste of what's coming next.

Second, and importantly, the voluntary market continues to experience fundamental growth even in difficult economic times. It has provided one of the only consistent sources of good news fight against climate change. As I discussed in an earlier blog post, the factors that affect buying decisions in the voluntary carbon market are quite different from those that drive most compliance credit purchasers. In the past it may have been easy for some observers to assume that voluntary market credits were "second best" - an unconsidered approach would be to assume verified emission reductions (VERs) were inferior because they sat outside the U.N. regulated system, and therefore that customers bought them only because they were less expensive than compliance credits.

That view would have been wrong. The reality is that VERs are not inferior, just different. Depending on your criteria, they may often be superior. And these different characteristics result in different market outcomes. Over the past year, many types of voluntary credits have held their value while CDM credit prices (CERs) are in free-fall. The growth paths of these two markets are diverging as well. While the total value of CDM transactions grew as a result of investor hedging and arbitrage strategies, both the volume and average price of over-the-counter VERs rose as a result of continued strong demand, leading to a 29% rise in market value, according to Ecosystem Marketplace. The decoupling of compliance and voluntary credit market behavior demonstrates that the voluntary market increasingly is able to stand on its own. Delegates at Carbon Expo sensed this, even before the results of the State of the Market survey were released.

The State of the Voluntary Carbon Markets 2012 report is packed with enough tables and graphs to satisfy any data junkie. Go read it yourself. After all, it's free.

But if you want only one take-away from the reams of data in the report, it is this: the voluntary market has stepped out of the shadow of the compliance market, and more and more companies recognise the benefits of using voluntary offset credits as part of their carbon reduction initiatives.

The Carbon Clear team is already busy digesting the detailed data from the report. We'd be delighted to share our analysis, and look forward to hearing from you.

Analysts, investors, and project developers rely on the State of report to help them make informed decisions and grow the market. This is an extremely valuable service, and somewhat surprisingly, Ecosystem Marketplace provides all this information free of charge via their website. It's a public service, and a valuable one. Carbon Clear is a proud sponsor of the report. Just one more way we contribute to the low-carbon economy.

A key finding from this year's report is that the voluntary carbon market has continued to grow strongly, even in the midst of an international economic and financial crisis. In fact, 2011 was the best year ever in terms of over-the-counter transactions. Excluding one very unusual 2010 transaction on the now-defunct CCX system, carbon credit sales volumes rose 28% in 2011, and the average price per tonne rose, too.

In many ways, the launch of the 2012 report marked the coming of age of the voluntary carbon market. The organisers of Carbon Expo operate mainly in the compliance market, focusing on carbon credits from the Clean Development Mechanism and EU Emission Trading Scheme (EU ETS). With thousands of industrial emitters covered under the EU Emission Trading Scheme (ETS) and scores of brokers and investment banks transferring credits back and forth, the compliance market is well over a hundred times larger than the voluntary one. To an outsider, a Carbon Expo session focused on the voluntary market would seem a side show, unlikely to be of interest to the majority of delegates. In the event, Ecosystem Marketplace was allocated a small room away from the main hall in which to launch their report on the voluntary market. They didn't even have a microphone.

And then something quite unexpected happened. The main hall of Carbon Expo sat half-empty, while delegates flocked to Meeting Room 2 to listen to Molly Peters-Stanley and the rest of the panel. They filled every seat, sat on the floor, stood against the walls and spilled out into the corridor beyond to hear the latest news on the voluntary market. There were nearly as many people standing outside as managed to make their way in. In the photo below you can just make out the throngs in the hallway craning their necks to see into the room.

Why such a big crowd to hear about a relatively small market?

The voluntary market has an importance and influence that belies its size. First, it has been a source of experimentation and innovation that has shown time and again how carbon finance can deliver clear livelihoods benefits to families and communities in developing countries. Voluntary carbon projects are often more effective at channeling resources into pro-poor initiatives like improved cook stoves and safe drinking water. Many methodological innovations, like sampling-based monitoring and "suppressed demand" started in the voluntary carbon credit standards and have subsequently found their way into the much larger UN-backed Clean Development Mechanism. So the voluntary market can help compliance market players get a taste of what's coming next.

Second, and importantly, the voluntary market continues to experience fundamental growth even in difficult economic times. It has provided one of the only consistent sources of good news fight against climate change. As I discussed in an earlier blog post, the factors that affect buying decisions in the voluntary carbon market are quite different from those that drive most compliance credit purchasers. In the past it may have been easy for some observers to assume that voluntary market credits were "second best" - an unconsidered approach would be to assume verified emission reductions (VERs) were inferior because they sat outside the U.N. regulated system, and therefore that customers bought them only because they were less expensive than compliance credits.

That view would have been wrong. The reality is that VERs are not inferior, just different. Depending on your criteria, they may often be superior. And these different characteristics result in different market outcomes. Over the past year, many types of voluntary credits have held their value while CDM credit prices (CERs) are in free-fall. The growth paths of these two markets are diverging as well. While the total value of CDM transactions grew as a result of investor hedging and arbitrage strategies, both the volume and average price of over-the-counter VERs rose as a result of continued strong demand, leading to a 29% rise in market value, according to Ecosystem Marketplace. The decoupling of compliance and voluntary credit market behavior demonstrates that the voluntary market increasingly is able to stand on its own. Delegates at Carbon Expo sensed this, even before the results of the State of the Market survey were released.

The State of the Voluntary Carbon Markets 2012 report is packed with enough tables and graphs to satisfy any data junkie. Go read it yourself. After all, it's free.

But if you want only one take-away from the reams of data in the report, it is this: the voluntary market has stepped out of the shadow of the compliance market, and more and more companies recognise the benefits of using voluntary offset credits as part of their carbon reduction initiatives.

The Carbon Clear team is already busy digesting the detailed data from the report. We'd be delighted to share our analysis, and look forward to hearing from you.

Subscribe to:

Comments (Atom)